Introduction

API Endpoint

https://api.trolley.com/v1/

Trolley’s API allows businesses to send payments to their recipients globally. Recipients can be either an individual or a business, such as freelance workers, contractors, affiliates, developers, designers, hosts, drivers, or even business suppliers around the world.

Our mission is to give more choice of payout methods to merchants world wide. What works for someone in San Francisco, London or Melbourne, might not be the best option for someone else in Jakarta, Nairobi or Mumbai. PayPal doesn’t support all countries, in fact, 97.5% of the population doesn’t have a PayPal account, and over 2 billion people don’t have a bank account. So clearly multiple payout options are needed to support a global business. That is why we plan to support every major payout method, so your users have choice of what works best for them.

Trolley currently supports direct payments to via bank transfer (in 220+ countries) and PayPal. In the near future, we will also support payments by mobile money, cash pick-up, paper checks and to existing debit or credit cards.

If you have an existing e-wallet service you use to make payouts (like PayPal), you can plug-in your business’ PayPal or other e-wallet account to our platform, and push payments out through your existing account with no additional fees from us. This allows you to have one consolidated payout platform to handle all your payouts, through one API integration. It also means that you can start offering direct-to-bank account payouts to your users, while offering your users a seamless transition from your current payout options.

We will always be looking to add the fastest, least expensive, most popular and most convenient payout methods that people want to use. So your business only ever has to integrate with one partner (us), and we will ensure you and your users always get access to the latest and greatest payout methods available on the market, at the most competitive rates.

Please review our API Terms of Use.

Before you start

Here is a quick summary of some common terms we use:

| Term | ID # Format | Description |

|---|---|---|

| Recipient | R-1a2B3c4D5e6F7g8H9i0J1k | A Recipient is the individual or business that you need to send a payment to. |

| Payment | P-1a2B3c4D5e6F7g8H9i0J1k | A Payment is an individual payout to a recipient. |

| Batch | B-1a2B3c4D5e6F7g8H9i0J1k | A Batch is a group of payments. |

| Transfer | T-1a2B3c4D5e6F7g8H9i0J1k | A Transfer is a deposit (or withdrawal) you make to your Trolley account from your company bank account, to fund your balance before sending payments. |

Getting Started

Overview

Trolley helps businesses send payouts (and manage associated tax details) to vendors, suppliers, artists, and independent contractors worldwide. The Trolley API helps you embed Trolley features directly within your platforms, systems, and logic.

In this document, we’ll walk you through 3 easy steps to send payments to your users.

Image 1: Getting Started with Trolley in 3 easy steps

Step 1 – API & Account Setup

You’ll need to set up a few things before you can get started with the Trolley API. Let’s review these details:

Get API Keys

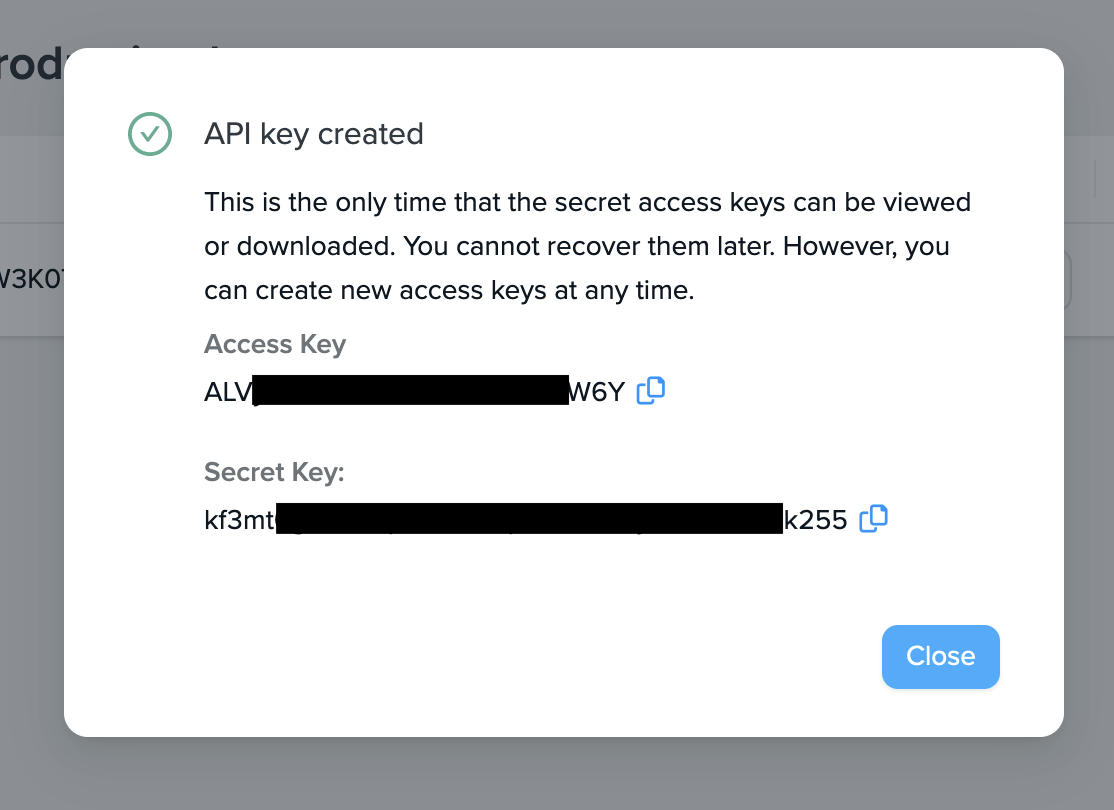

The Trolley API uses a pair of keys to authenticate your requests. This pair contains an API Access Key and a corresponding API Secret Key.

To acquire the API Access Key and the API Secret Key, go to Trolley Dashboard > Settings > API Keys and generate the pair.

Image 2: A screencast showing how to navigate to API Keys section within the Trolley settings interface.

If you have created API Keys before, only the API Access Keys will be listed here.

Click on the Create Key button on the top right to create a new API Access Key and API Secret Key. A dialog box will appear displaying the pair of keys.

Image 3: A screenshot of the API Key Creation dialog box showing sample API Keys.

Note: The API Secret will be visible only in this dialog box, so make sure you copy the pair and save it somewhere safe.

You’ll need this API Key and API Secret pair to access the Trolley API, and with the Trolley SDKs.

Live and Sandbox modes

Your account includes access to a “sandbox” environment where you can test the API and other features without impacting your production environment or potentially transferring real funds. Consider this as a testing environment to test run your integrations.

API Keys differ for sandbox and live environments. You can switch between them easily from your dashboard.

To switch between Live and Sandbox environments, click your account avatar at the top right corner of the Trolley interface. In the dropdown, click on the account name with “sandbox” or “live” suffix.

Image 4: A screencast demonstrating how to switch between live and sandbox environments in Trolley.

You can add teammates to either environment and give them different roles in each.

Note that the developer role cannot create API keys in Live mode.

Request URL and Content type

The Request URL, the address where to send API requests, consists of two main parts: a base url and a version number.

Base url: https://api.trolley.com

API Version: v1

The corresponding Request URL would be written: https://api.trolley.com/v1/…

All resources that you need to access, will be appended to this request URL. Some examples:

Some examples:

Request Content Type: Content-type: application/json

All request types must provide the above header if they’re sending a JSON body in the request.

'Authorization': 'prsign AVaAj764JE7C:

ce1f667c9cfee7a9291c61f68ff98144cc08c0291bbdcc3d0'

Authentication

The API Authentication model expects you to provide an Authorization header.

Create the authorization header by sha256 encoding a combination of the current timestamp, request type, request path, and the body.

Any requests older than 30 seconds will be rejected. A typical authentication header will look like the one displayed in the example.

'X-PR-Timestamp': '1656393402'

Along with the Authorization header, you should also send a custom header X-PR-Timestamp with the current timestamp as its value.

An example of the X-PR-Timestamp is shown in the right pane.

To learn how to compute the Authentication header, please read through our Authentication guide: https://docs.trolley.com/api#authentication

curl

-H "Authorization:prsign ALJVaAj4Z764JE7C:ce1f667913c9ca794cd89291c61f68ff98144291bbdcc3d0"

-H "X-PR-Timestamp:'1656393402'"

-L -X GET "https://api.trolley.com/v1/recipients/R-BawfevFF8oWx" \

Sample Request

With your API Access Key, API Secret Key, and Authentication processes in place, you’re ready to send requests to our APIs. You can use your preferred programming language to send HTTP requests to our APIs.

A sample cURL request to get details about a single recipient is shown in the example.

Step 2 - Add Recipient

Before you can send payments to recipients, they need to be added to your Trolley merchant account. You can use the Trolley Widget to add new recipients and their tax information. Alternatively, you can bulk upload recipients as a CSV file to import recipients from your previous system.

Using Trolley Widget to add recipients

The Trolley Widget is a handy way for your recipients to self-onboard their payment and tax information to your merchant account. Using the Widget, recipients can add multiple payment methods such as bank account, PayPal, or check. Using the same widget, the recipients can upload tax-related information and forms.

The Trolley Widget is integrated as an iframe and supports many configuration options. Supplying a recipient’s email address is the only requirement to initiate the recipient’s self-onboarding process.

To display the widget to a recipient, you should:

- Build a Widget URL with required configuration options.

- Host it on a webpage you own and control.

- Share that webpage’s URL with your recipients.

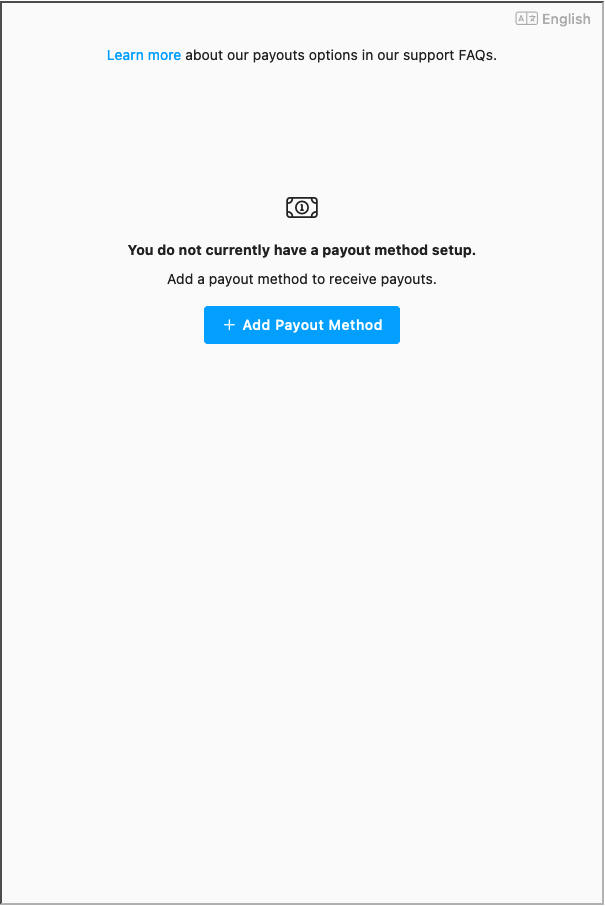

Once loaded, the iframe will look something like this:

Image 5: Screenshot of the Trolley Widget for a user with no payment method on file.

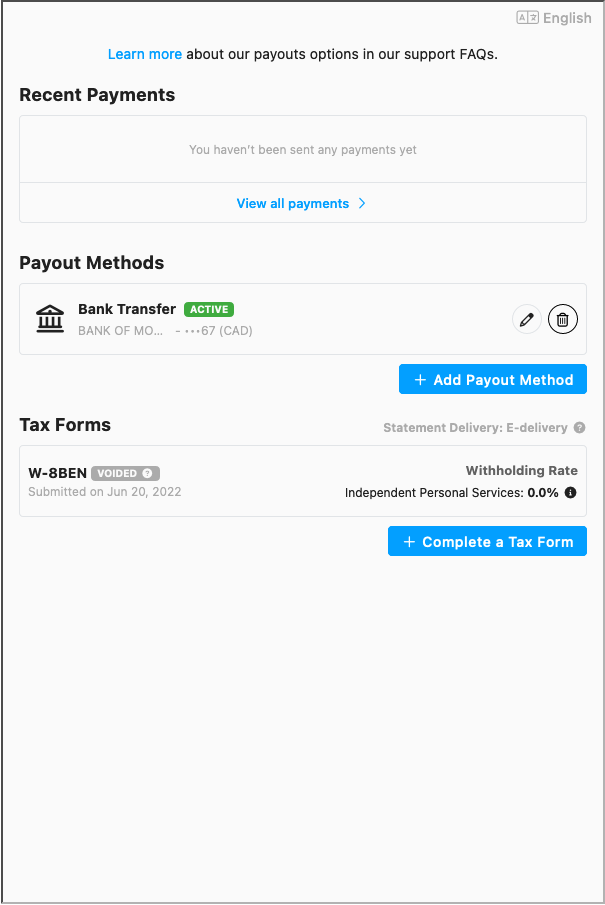

Once the recipient fills in their information, the Trolley Widget looks like the following:

Image 6 Screenshot of the Trolley Widget for a user with payment methods on file.

The Widget also emits multiple JS events when a payment method or a tax form is added. You can listen for these events to trigger any necessary actions (e.g. closing a mobile web browser window when a recipient is done adding payment details).

Every recipient will be assigned a new recipientId, a unique indicator which will look something like this: R-XgtzXghfxx4E4Y3R.

This recipientId is used across the Trolley API to recognize a recipient and take actions for them such as sending a payment, checking statuses, etc.

To learn more about how to create, modify, and use the Trolley Widget, visit the Widget documentation: https://docs.trolley.com/widget/

Import Recipients

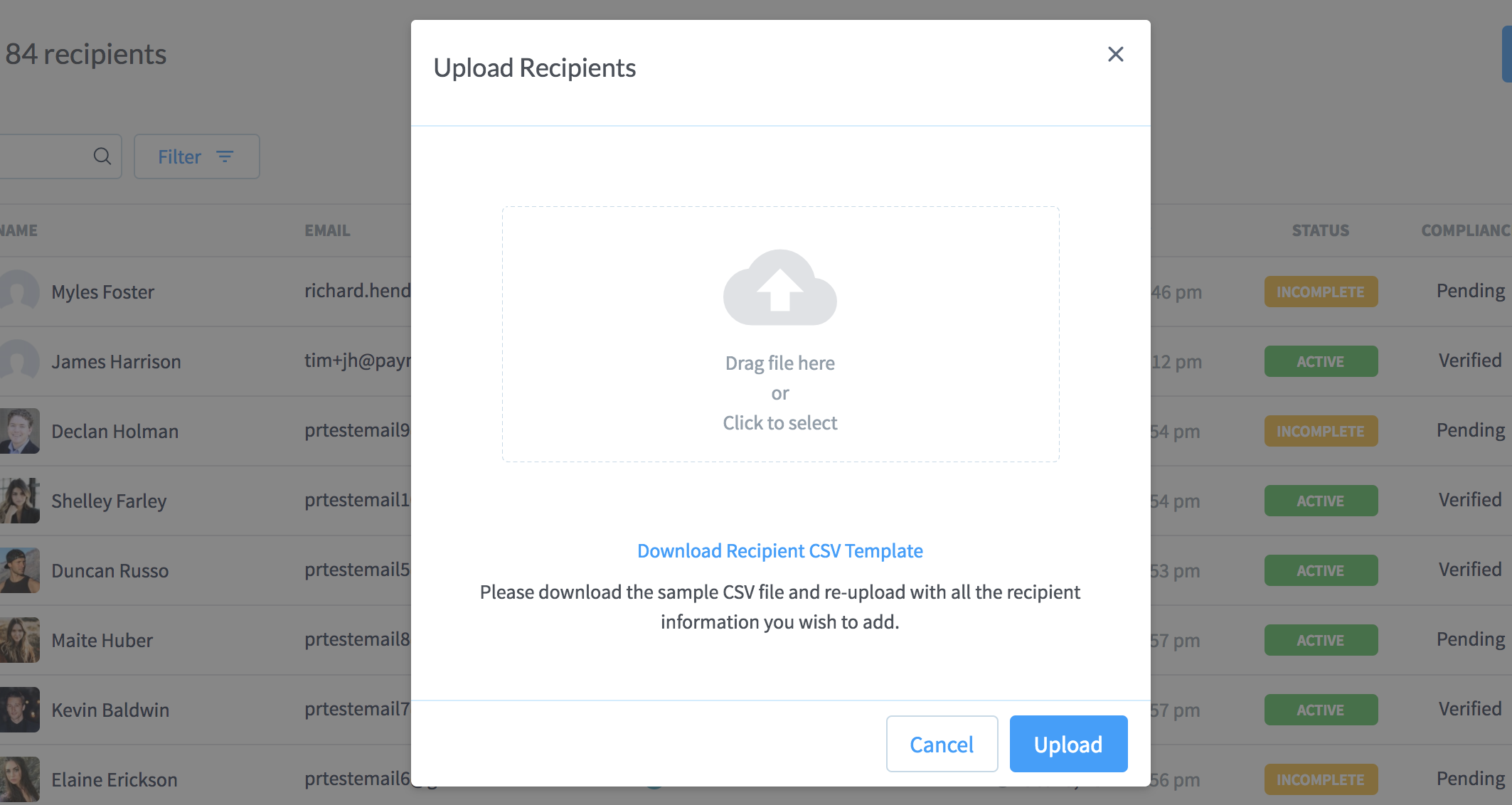

If you have existing recipient information in a system you already use and maintain, you can import that information directly to your Trolley merchant dashboard as a mass import. You’ll need to upload a properly formatted CSV file to import these recipients’ information.

To do this, go to the Dashboard and click on the Recipients tab from the main menu. From the top right corner, click the drop-down arrow next to the “Add Recipient” button and select “Upload CSV File”.

Image 7: Screencast of the Add Recipient button options, to show where to find “upload CSV” option

This will open a dialog box where you can upload the CSV file containing the recipient information. From here you can also download the template demonstrating the correct CSV format required by the Trolley system to format your CSV file accordingly:

Image 8: Screenshot of the Upload CSV dialog box

To learn more about how to add Recipients manually, either one by one or in bulk, check out the “How to Add a New Recipient” help article: https://help.trolley.com/en/articles/483504-how-to-add-a-new-recipient

You can also add recipients via the API, which is discussed here: https://docs.trolley.com/api/#create-a-recipient

Managing Recipients

Once recipients are added or uploaded, you can manage or edit individual recipient records via the dashboard or the API.

To learn more about how to manage recipients via the API, refer to our API documentation about recipients: https://docs.trolley.com/api#retrieve-a-recipient

Step 3 - Send Payment

Once recipients have been added and are active, you can send them payments. An active recipient must have a valid address, valid payment method, and a tax form uploaded (if applicable).

To send a payment to an active recipient, you use the Batches function.

Here’s a quick rundown of the steps required to send a payment to a recipient:

1. Create a Batch

In the Trolley ecosystem, all payments are sent as a part of a Batch. A batch can have 0 or multiple payments in it. One batch can have payments meant for multiple recipients, so a batch is not unique to a recipient. A payment cannot exist without a batch.

To create a Batch via the Trolley API, you’ll have to send a POST request to the https://api.trolley.com/v1/batches api endpoint.

After successful creation of a Batch, you’ll receive a batchId which looks like this: B-1a2B3c4D5e67g8H90J1k

This batchId will be used to access this batch for any future needs.

For full details on how to create a batch, please refer to this document: https://docs.trolley.com/api/#create-a-batch

2. Add Payments to the Batch

You can add a payment to a batch while creating the batch itself. But if needed, payments can be added to an existing batch before sending it.

To add a payment to an existing batch with a batchId, send a POST request to the https://api.trolley.com/v1/batches/:id/payments endpoint, where :id is the batchId of the batch you want to add this payment into.

For full details on how to add a payment to a batch, please refer to this document: https://docs.trolley.com/api/#create-a-payment

3. Send the batch to processing

Once a batch is ready, with all the payments that need to be sent, you can send the batch for processing. Once the batch is sent for processing, you cannot edit or delete it.

To send a batch for processing, you’ll have to send a POST request to the https://api.trolley.com/v1/batches/:batch-id/start-processing endpoint, with the appropriate batchId.

The batch will run through the validations and will be marked as processed if all the validations and requirements are met—validations include things like checking if you have a sufficient account balance. Until the validations are complete, the batch remains in a processing state. Once the validation is complete and the transaction is triggered, the batch will be marked as processed. Note that processing a batch may take some time.

You can see all potential statuses of batches and other objects here: https://docs.trolley.com/api/#list-of-statuses

To learn more about how to send a payment through a batch, refer to this documentation: https://docs.trolley.com/api/#payments

Invoices

If you have multiple payments for a single recipient in a pay-run, you can use Invoices for better management and reporting of those payments.

You can create an invoice, add line items to the invoice denoting the purpose of various payments, create an Invoice Payment, then send the associated batch to the created Payment for processing.

To learn more about Invoices, please refer to the Invoices documentation: https://docs.trolley.com/api/#invoices

Managing Payments

Like recipients, you can manage batches and payments via the API and perform CRUD operations on them (depending on which state they are in).

To learn more, you can explore different API endpoints pertaining to batches and payments further in our API documentation: https://docs.trolley.com/api#payments

We can’t wait to see the payment experiences you build with the Trolley API. For more details and in-depth documentation of all features, visit the remaining sections of this API document. Refer to the further reading section below for more suggested reading as you start building with Trolley.

Further Reading

-

To get notified about updates to Payments, Recipients and more, subscribe to Webhooks

-

See a definitive list of potential payments, recipients, and batches statuses in List of Statuses.

-

Find answers to common questions, or contact us by visiting Support and FAQs.

Interacting with the API

Making requests

The Trolley API follows RESTful design principles. We use the following HTTP verbs:

GET- Read resourcesPOST- Create new resourcesPATCH- Update an existing resourceDELETE- Remove resources

When making requests, arguments can be passed as params or JSON with correct Content-Type header of application/json.

Success Codes

The Trolley API uses the following successful response codes:

| Success Code | Meaning |

|---|---|

| 200 | Ok – Request processed successfully |

Error Codes

Example API response for object not found

{

"ok": false,

"errors": [

{

"code": "not_found",

"message": "Object not found"

}

]

}

Example API Failure for validation

{

"ok": false,

"errors": [

{

"code": "empty_field",

"field": "type",

"message": "Expected to have a non-null or non-empty value"

},

{

"code": "empty_field",

"field": "name",

"message": "Expected to have a non-null or non-empty value"

}

]

}

The Trolley API uses the following error codes:

| Error Code | HTTP Code | Description |

|---|---|---|

| invalid_status | 400 | Status of an object is invalid |

| invalid_field | 400 | Field value is invalid |

| empty_field | 400 | Field value is required but not provided |

| expired_quote | 400 | Quote is expired |

| invalid_api_key | 401 | API key is invalid |

| not_authorized | 403 | Authentication not permitted to access resource |

| not_found | 404 | Object not found |

| rate_limit_exceeded | 429 | Rate limit exceeded |

| partner_integration_error | 500 | Error occured with one of our partners |

| internal_server_error | 500 | Internal server error |

In the event that the API returns an error, the response body will contain the following information:

Response

| Key | Meaning |

|---|---|

ok |

Boolean false – The API call failed |

errors |

Array of descriptions, more detail on the failures, this may be multiple values for validation failures or a single value for other failures. |

CORS

Trolley API supports cross-origin HTTP requests which is commonly referred to as CORS. This means that you can call API resources using Javascript from any browser. While this allows many interesting use cases, it’s important to remember that you should never expose private API keys to 3rd parties. CORS is mainly useful with unauthenticated endpoints and OAuth2 client side applications.

Fields

| Type | Description |

|---|---|

| string | An arbitrary string value |

| integer | Integer number |

| float | Floating point number |

| date | All dates are represented in in ISO 8601 format in the UTC (Z) timezone (e.g. “2015-07-01T00:55:47Z) |

| country | All country codes are ISO ALPHA-2 country codes (e.g. “US”, “CA”, or “JP”) |

| amount | All amounts are in string format in order to avoid rounding problems with floating point numbers. The only allowed formats are positive numeric values with either two decimal places or no decimal (e.g. “1.99” or “123”). |

| currency | The type of currency is in ISO 4217 (e.g. “USD”, “CAD”, or “JPY”) |

Rate limiting

The Trolley API is rate limited to prevent abuse that would degrade our ability to maintain consistent API performance for all users.

The rate limits are as follows:

- 200 requests per minute from any single IP address

- 100 requests per minute for any regular merchant

- 50 requests per minute for any sandbox merchant

If your requests are being rate limited, HTTP response code 429 will be

returned with an rate_limit_exceeded error. Contact us to discuss rate limits at api@trolley.com.

Deprecation Policy

Technology evolves quickly and we are always looking for better ways to serve our customers. From time to time we need to make room for innovation by removing sections of code that are no longer necessary. We understand this can be disruptive and consequently we have designed a Deprecation Policy that protects our customers’ investment and that allows us to take advantage of modern tools, frameworks and practices in developing software.

Deprecation means that we discourage the use of a feature, design or practice because it has been superseded or is no longer considered efficient or safe but instead of removing it immediately, we mark it as Deprecated to provide backwards compatibility and time for you to update your projects. While the deprecated feature remains in the API and/or SDK for a period of time, we advise that you replace it with the recommended alternative which is explained in the relevant section of API documentation or the SDK code.

We remove deprecated features after 3 months from the time of announcement.

The security of our customers’ assets is of paramount importance to us and sometimes we have to deprecate features because they may pose a security threat or because new, more secure, ways are available. On such occasions we reserve the right to set a different deprecation period which may range from immediate removal to the standard 3 months.

Once a feature has been marked as deprecated, we no longer develop the code or implement bug fixes. We only do security fixes.

Authentication

All calls to the Trolley API require authentication. You will need to get an access key and secret key from the dashboard via the settings page.

Signing requests

API Key authentication requires each request to be signed, this ensures that your secret key is not part of the transmission.

Making a request

Example of generating Authorization header and sending API requests

# Bash sample only includes example of sending a request.

# For sample code of generating Trolley Authorization header please

# view samples of other supported programming languages

curl \

-H 'Authorization: prsign <ACCESS-KEY>:<SIGNATURE>' \

-H 'Content-Type: application/json' \

-H 'X-PR-Timestamp: <timestamp>' \

-X POST 'https://api.trolley.com/v1/recipients' \

--data-raw '{

"type": "individual",

"firstName": "Elon",

"lastName": "Mask",

"email": "elon@mask.com"

}'

# Requires python-requests. Install with pip:

#

# pip install requests

#

import json, hmac, hashlib, time, requests

from requests.auth import AuthBase

# Your key and secret as obtained by the Dashboard UI

ACCESS_KEY = '<YOUR_ACCESS_KEY>'

SECRET_KEY = '<YOUR_SECRET_KEY>'

# Create custom authentication for Trolley API

class TrolleyAuth(AuthBase):

def __init__(self, access_key, secret_key):

self.access_key = access_key

self.secret_key = secret_key

def __call__(self, request):

print "PATH", request.path_url

timestamp = str(int(time.time()))

# if non-empty, body should be a valid JSON in string format

message = '\n'.join([timestamp, request.method, request.path_url, (request.body or ''), ''])

signature = hmac.new(self.secret_key, message, digestmod=hashlib.sha256).hexdigest()

request.headers.update({

'Authorization': 'prsign %s:%s' % (self.access_key, signature),

'X-PR-Timestamp': timestamp,

})

print request.headers

return request

api_url = 'https://api.trolley.com/v1/'

auth = TrolleyAuth(ACCESS_KEY, SECRET_KEY)

# Get list of recipients

r = requests.get(api_url + 'recipients', auth=auth)

print r.json()

function getTrolleyAuthHeader(params){

const timestamp = Math.round(Date.now()/1000);

const message =

`${timestamp}\n

${params.method}\n

${params.requestPath}\n

${params.body}\n`; // if non-empty, body should be a valid JSON in string format

const signature = crypto.createHmac("sha256", params.SECRET_KEY).update(message).digest("hex");

var trolleyHeaders = {

Authorization: `prsign ${params.ACCESS_KEY}:${signature}`,

"X-PR-Timestamp": timestamp,

"Content-Type": "application/json"

}

return trolleyHeaders;

}

...

const ACCESS_KEY = '<YOUR_ACCESS_KEY>';

const SECRET_KEY = '<YOUR_SECRET_KEY>';

fetch("https://api.trolley.com/v1/recipients", {

method: 'get',

headers: getTrolleyAuthHeader({

method: 'get'.toUpperCase(),

requestPath: '/v1/recipients',

body: '', // if non-empty, body should be a valid JSON in string format

ACCESS_KEY: ACCESS_KEY,

SECRET_KEY: SECRET_KEY

}),

})

.then(result => console.log(result))

.catch(error => console.log('error', error));

function getTrolleyAuthHeaders($params){

$timestamp = time();

$message = join("\n", [$timestamp, $params["method"], $params["requestPath"], $params["body"]]);

$signature = hash_hmac("sha256", $message, $params["accessSecret"]);

$authHeader[] = "Authorization: prsign " . $params["accessKey"] . ":" . $signature;

$authHeader[] = "X-PR-Timestamp: " . $timestamp;

$authHeader[] = "Content-Type: application/json";

$authHeader[] = "Accept: application/json";

return $authHeader;

}

...

$accessKey = "<YOUR_ACCESS_KEY>";

$accessSecret = "<YOUR_SECRET_KEY>";

$curl = curl_init();

curl_setopt_array($curl, array(

CURLOPT_URL => "https://api.trolley.com/v1/recipients",

CURLOPT_RETURNTRANSFER => true,

CURLOPT_HTTP_VERSION => CURL_HTTP_VERSION_1_1,

CURLOPT_CUSTOMREQUEST => "GET",

CURLINFO_HEADER_OUT => true,

CURLOPT_HTTPHEADER => getTrolleyAuthHeaders(

array(

"method" => strtoupper("GET"),

"requestPath" => "/v1/recipients",

"body" => "", // if non-empty, body should be a valid JSON in string format

"accessKey" => $accessKey,

"accessSecret" => $accessSecret

)

),

));

$response = curl_exec($curl);

curl_close($curl);

print_r($response);

require 'digest'

require 'net/http'

require 'openssl'

require 'uri'

require 'json'

def get_trolley_auth_header (params)

timestamp = Time.now.to_i

message = [timestamp, params[:method], params[:requestPath], params[:body]].join("\n") + "\n"

signature = OpenSSL::HMAC.hexdigest(OpenSSL::Digest.new('sha256'), params[:secret_key], message)

{'X-PR-Timestamp': timestamp.to_s,

'Authorization': 'prsign ' + params[:access_key] + ':' + signature,

'Content-Type': 'application/json'}

end

ACCESS_KEY = '<YOUR_ACCESS_KEY>';

SECRET_KEY = '<YOUR_SECRET_KEY>';

headers = get_trolley_auth_header ({method: 'GET',

requestPath: '/v1/recipients',

body: '', # if non-empty, body should be a valid JSON in string format

access_key: ACCESS_KEY,

secret_key: SECRET_KEY

})

...

uri = URI.parse('https://api.trolley.com/v1/recipients')

http = Net::HTTP.new(uri.host, uri.port)

http.use_ssl = true

request = Net::HTTP::Get.new(uri, headers)

response = http.request(request)

puts response.body["ok"]

//This sample uses .Net Core

using System.Net;

using System.Net.Http.Headers;

using System.Security.Cryptography;

using System.Text;

void setTrolleyAuthHeaders(string method, string requestPath, string body, string accessKey, string secretKey, ref HttpClient httpClient)

{

TimeSpan epochTicks = new TimeSpan(new DateTime(1970, 1, 1).Ticks);

TimeSpan unixTicks = new TimeSpan(DateTime.UtcNow.Ticks) - epochTicks;

int timeStamp = (int)unixTicks.TotalSeconds;

string message = timeStamp + "\n" + method + "\n" + requestPath + "\n" + body + "\n";

ASCIIEncoding encoding = new ASCIIEncoding();

Byte[] messageBytes = encoding.GetBytes(message);

Byte[] accessKeyBytes = encoding.GetBytes(secretKey);

HMACSHA256 hash = new HMACSHA256(accessKeyBytes);

Byte[] hashBytes = hash.ComputeHash(messageBytes);

var signature = BitConverter.ToString(hashBytes).Replace("-", "").ToLower();

var authHeader = "prsign " + accessKey + ":" + signature;

httpClient.DefaultRequestHeaders.Add("Authorization", authHeader);

httpClient.DefaultRequestHeaders.Add("X-PR-Timestamp", timeStamp.ToString());

httpClient.DefaultRequestHeaders

.Accept

.Add(new MediaTypeWithQualityHeaderValue("application/json"));

}

...

string ACCESS_KEY = "<YOUR_ACCESS_KEY>";

string SECRET_KEY = "<YOUR_ACCESS_SECRET>";

var httpClient = new HttpClient(

new HttpClientHandler {

AutomaticDecompression = DecompressionMethods.GZip

| DecompressionMethods.Deflate });

setTrolleyAuthHeaders(

"get".ToUpper(),

"/v1/recipients",

"", // if non-empty, body should be a valid JSON in string format

ACCESS_KEY,

SECRET_KEY,

ref httpClient);

httpClient.BaseAddress = new Uri("https://api.trolley.com");

HttpResponseMessage response = httpClient.GetAsync("/v1/recipients").Result;

response.EnsureSuccessStatusCode();

string result = response.Content.ReadAsStringAsync().Result;

Console.WriteLine("Result: " + result);

import java.io.BufferedReader;

import java.io.IOException;

import java.io.InputStreamReader;

import java.io.UnsupportedEncodingException;

import java.net.HttpURLConnection;

import java.net.URL;

import java.security.InvalidKeyException;

import java.security.NoSuchAlgorithmException;

import java.util.HashMap;

import javax.crypto.Mac;

import javax.crypto.spec.SecretKeySpec;

...

HashMap<String, String> getTrolleyAuthHeaders(HashMap<String, String> params)

throws UnsupportedEncodingException,

InvalidKeyException,

NoSuchAlgorithmException{

HashMap<String,String> headerValues = new HashMap<String, String>();

int timeStamp = (int) (System.currentTimeMillis() / 1000L);

String message = timeStamp + "\n"

+ params.get("method") + "\n"

+ params.get("requestPath") + "\n"

+ params.get("body")

+ "\n";

String digest = null;

final SecretKeySpec key = new SecretKeySpec((params.get("secretKey")).getBytes("UTF-8"), "HmacSHA256");

Mac mac = Mac.getInstance("HmacSHA256");

mac.init(key);

byte[] bytes = mac.doFinal(message.getBytes("ASCII"));

StringBuffer hash = new StringBuffer();

for (int i = 0; i < bytes.length; i++) {

String hex = Integer.toHexString(0xFF & bytes[i]);

if (hex.length() == 1) {

hash.append('0');

}

hash.append(hex);

}

digest = hash.toString();

headerValues.put("Authorization", "prsign " + params.get("accessKey").toString() + ":" + digest);

headerValues.put("X-PR-Timestamp", ""+timeStamp);

headerValues.put("Content-Type", "application/json");

return headerValues;

}

...

String ACCESS_KEY = "<YOUR_ACCESS_KEY>";

String SECRET_KEY = "<YOUR_SECRET_KEY>";

try {

URL obj = new URL("https://api.trolley.com/v1/recipients");

HttpURLConnection con = (HttpURLConnection) obj.openConnection();

con.setRequestMethod("GET");

HashMap<String, String> headerValues = getTrolleyAuthHeaders(new HashMap<String,String>(){{

put("method", "get".toUpperCase());

put("requestPath", "/v1/recipients");

put("body",""); // if non-empty, body should be a valid JSON in string format

put("accessKey", ACCESS_KEY);

put("secretKey", SECRET_KEY);

}});

//Setting header values

for (String i : headerValues.keySet()) {

con.setRequestProperty(i, headerValues.get(i));

}

BufferedReader in = new BufferedReader(new InputStreamReader(con.getInputStream()));

String inputLine;

StringBuffer response = new StringBuffer();

while ((inputLine = in.readLine()) != null) {

response.append(inputLine);

}

in.close();

System.out.println(response.toString());

}catch (IOException e) {

e.printStackTrace();

}

All REST requests must contain the following headers:

AuthorizationWhere your signed request information will be transmittedX-PR-TimestampThe timestamp of your request

All request bodies should have a content type of application/json and be valid JSON.

The Authorization header will have the format of Authorization: prsign ACCESS_KEY:REQUEST_SIGNATURE

The REQUEST_SIGNATURE is computed by creating a sha256 HMAC using the secret key on the prehash string and timestamp + '\n' + method + '\n' + requestPath + '\n' + body + '\n'.

timestampThis is the same value as transmitted in theX-PR-Timestampheader and is the seconds past 1970 (Unix Epoch) in UTC time.methodThe request method in all upper case.requestPathThe full request path including all query parameters (e.g./v1/recipients/?search=bob)bodyThe JSON body of the request.

Additional Security for API Keys

For enhanced API Key security, we recommend that you whitelist IP addresses that are permitted to make requests. You can do this in ‘Settings’ section of the merchant dashboard under the ‘Security’ tab.

Recipients

A recipient is an individual or company that can receive payments, such as freelancers, contract workers, suppliers, marketplace sellers, employees, etc. Basically, anyone your business needs to pay.

Recipients can receive payouts directly to their Bank Account or their PayPal account (with more payout options coming soon, such as Mobile Money, and Debit/Credit Cards).

Recipients must be created prior to sending a payment to them. When you create a recipient, we automatically generate and assign a unique recipient Id. The format of all recipient IDs are “R-1a2B3c4D5e6F7g8H9i0J1k”, with the ‘R-’ prefix indicating Recipient.

Recipient Attributes

Example Recipient

{

"id": "R-1a2B3c4D5e6F7g8H9i0J1k",

"referenceId": "U341553728",

"email": "richard@example.com",

"name": "",

"lastName": "Richard",

"firstName": "Hendricks",

"status": "active",

"complianceStatus": "review",

"gravatarUrl": "https://www.gravatar.com/avatar/205e460b479e2e5b48aec07710c08d50",

"language": "en",

"dob": "1991-12-23",

"passport": "HA24123423",

"ssn": "123-45-6789",

"governmentIds":[

{

"country": "US",

"type": "SSN",

"value": "********1234"

},

{

"country": "US",

"type": "passport",

"value": "********1234"

}

],

"routeType": "eft",

"routeMinimum": 1,

}

| Attribute | Description |

|---|---|

| id string |

A system generated ID number assigned to the recipient by Trolley. |

| referenceId string |

Recipient reference ID as assigned by your business (your internal user reference number, e.g. ‘U1234556678’) |

| email required string |

Email address of recipient (e.g. ‘john@email.com’) |

| name required if type is Business string |

Name of Business (e.g. ABC Company Ltd). Required if Type is Business. (Note: If type is Individual, we will automatically populate this field with firstname and lastname of individual). |

| lastName required if type is Individual string |

Recipient’s Last name (surname), (e.g. ‘Smith’). Required if Type is Individual. Optionally can provide contact persons last name if Type is Business. |

| firstName required if Type is Individual string |

Recipient’s First name (e.g. ‘John’). Required if Type is Individual. Optionally can provide contact persons first name if Type is Business. |

| status string |

Status of a recipient in the system |

| complianceStatus string |

AML watchlist compliance screening status for the Recipient. A Recipient’s compliance review can either be pending (default), or ongoing (review), has passed (verified), or has been flagged for further review (blocked). |

| gravatarUrl string |

The gravatar url of recipient |

| language string |

2-letter ISO 639-1 language code and optional 2-letter ISO-3166 country code. (eg. “en” and “en-CA” both are acceptable) Supported Languages |

| dob date |

Date of Birth (YYYY-MM-DD) |

| passport string |

Passport number |

| governmentIds array |

Government IDs or Tax ID numbers (e.g. 123456798910). Required for bank transfer payout method. Each object in this array represents one government Id. Refer to the example in the response sample above. Some countries require specific IDs: If Individual: Argentina (CUIT, 11 digits), Azerbaijan (TIN, 10 digits), Brazil (CPF, 11 digits), Chile (RUT/RUN, 9 digits), Colombia (NIT, 10 digits), Costa Rica (Cedula Juridica, 9-12 digits), Guatemala (NIT, 8-12 digits), Kazakhstan (IIN, 12 digits), Paraguay (6-11 digits). If Business: Argentina (CUIT, 11 digits), Brazil (CNPJ, 14 digits). For more details, check Country Requirements Reference Doc. |

| address object |

Address details of recipient |

| routeType string |

The route that recipient will receive payout with. Depends on Recipient’s country and active payment method. Sample values are eft, ach, fps, sepa, wire, transfer etc. |

| routeMinimum number or null |

Minimum amount that you can send to this recipient. A null value indicates a recipient’s profile is not complete |

| accounts object |

Recipient Account information |

| tags array |

A collection of keywords to help identify the recipient. |

| contactEmails array |

A list of secondary email addresses that will be CC’d in all recipient emails (excluding Portal login code/authentication emails). |

Address

Example Address

{

"street1": "123 Main St",

"street2": "",

"city": "San Francisco",

"region": "CA",

"postalCode": "94131",

"country": "US",

"phone": "18005551212"

}

| Field | Description |

|---|---|

| street1 required string |

Recipient’s Street 1 Address. Please do not provide PO Box Address. (E.g. 123 Sample Street). Required for bank transfer payout method. Otherwise it is optional. |

| street2 optional string |

Recipient’s Street 2 Address (e.g. Apt 5). |

| city required string |

Recipient’s address City (e.g. Miami). Required for bank transfer payout method. Otherwise it is Optional. |

| postalCode optional string |

Recipient’s address Postal code or Zip code (e.g. 90210, M5X 2X1, 2000). |

| country required string |

Recipient Country. Required for bank transfer payout method.Otherwise it is Optional. We accept ISO 3166-1 alpha-2 (e.g. ‘US’, ‘DE’) |

| region optional string |

Region code Recipient’s address Region (state/ province / county). We accept both ISO 3166-2 code (e.g. FL), and full state/province name (e.g. Florida). ISO 3166-2 code is highly recommended. |

| phone optional string |

Recipient’s phone number (e.g. 415-123-0000 or +14151230000). Required for bank transfer payout method for these countries only: Argentina, Bangladesh, Brazil, Chile, China, Colombia, Costa Rica, Ethiopia, Fiji, Guatemala, Jordan, Kazakhstan, Kiribati, Korea (South), Mongolia, Russia, South Africa, Taiwan, Thailand, Tuvalu, Togo, Tonga. Otherwise it is optional. |

Payout Method

For further information read about the Payout Method Attributes

Create a recipient

Example request

curl \

-H 'Authorization: prsign <ACCESS-KEY>:<SIGNATURE>' \

-H 'Content-Type: application/json' \

-H 'X-PR-Timestamp: <timestamp>' \

-X POST 'https://api.trolley.com/v1/recipients/' \

--data-raw '{

"referenceId": "A-104",

"type": "individual",

"firstName": "Leonardo",

"lastName": "da Vinci",

"email": "leonardo@davinci.it",

"dob": "1902-04-15",

"address": {

"street1": "191, Royal Library of Turin",

"street2": "P.za Castello",

"city": "Torin TO",

"postalCode": "10122",

"country": "IT"

},

"governmentIds":[

{

"country":"IT",

"type":"other",

"value":"ABCD123123"

}

]

}'

<?php

use Trolley;

Trolley\Configuration::publicKey('YOUR_ACCESS_KEY');

Trolley\Configuration::privateKey('YOUR_SECRET_KEY');

$recipient = Trolley\Recipient::create([

'type' => "individual",

'firstName' => 'Tom',

'lastName' => 'Jones',

'email' => 'jsmith@example.com',

'address' => [

"city" => "Montréal",

"country" => "CA",

"phone" => "+15141111111",

"postalCode" => "A1A 1A1",

"region" => "BC",

"street1" => "Toad Street",

"street2" => "Avenue Rock",

],

]);

print_r($recipient);

?>

// Running in Node.js environment

const trolley = require("trolley");

const client = trolley.connect({

key: "YOUR_ACCESS_KEY",

secret: "YOUR_SECRET_KEY"

});

const recipient = await client.recipient.create(

{

type: "individual",

firstName: "John",

lastName: "Smith",

email: "jsmith@example.com",

address: {

city: "Montréal",

country: "CA",

phone: "+15141111111",

postalCode: "A1A 1A1",

region: "BC",

street1: "Toad Street",

street2: "Avenue Rock"

}

}

);

console.log(recipient.id);

require 'trolley'

client = Trolley.client('YOUR_ACCESS_KEY', 'YOUR_SECRET_KEY')

response = client.recipient.create(

{

type:"individual",

firstName: 'John',

lastName: 'Smith',

email: 'jsmith@example.com',

address: {

city: "Montréal",

country: "CA",

phone: "+15141111111",

postalCode: "A1A 1A1",

region: "BC",

street1: "Toad Street",

street2: "Avenue Rock"

}

account: {

type: 'paypal',

emailAddress: 'jsmithpaypal@example.com'

}

})

print response;

from trolley.configuration import Configuration

client = Configuration.gateway(f'{ACCESS_KEY}', f'{SECRET_KEY}')

payload = {

"type": "individual",

"firstName": "Tom",

"lastName": "Jones",

"email": "tom.jones@example.com"

}

response = client.recipient.create(payload)

print(response)

...

Configuration config = new Configuration("<ACCESS_KEY>","<SECRET_KEY>");

Gateway client = new Gateway(config);

// Create a new Recipient request object

Recipient recipientRequest = new Recipient();

recipientRequest.setType("individual");

recipientRequest.setFirstName("John");

recipientRequest.setLastName("Smith");

recipientRequest.setEmail("john.smith@example.com");

// Create and add an Address

Address address = new Address();

address.setStreet1("123 Main St");

address.setCity("San Francisco");

address.setRegion("CA");

address.setPostalCode("94131");

address.setCountry("US");

address.setPhone("18005551212");

recipientRequest.setAddress(address);

// Create and add government ID

GovernmentId govtId = new GovernmentId("US", "SSN", "ABCD123456");

ArrayList<GovernmentId> govtIds = new ArrayList<GovernmentId>();

govtIds.add(govtId);

recipientRequest.setGovernmentIds(govtIds);

Recipient recipient = client.recipient.create(recipientRequest);

System.out.println(recipient.getId());

...

using Trolley.Types;

using Trolley;

...

Gateway gateway = new Trolley.Gateway("<ACCESS_KEY>", "<SECRET_KEY>");

Recipient recipientRequest = new Recipient();

recipientRequest.type = "individual";

recipientRequest.email = "tom.jones@example.com";

recipientRequest.firstName = "Tom";

recipientRequest.lastName = "Jones";

recipientRequest.dob = "1990-01-01";

recipientRequest.address = new Address("street1", "city", "US", "AL", "12345");

Recipient recipient = gateway.recipient.Create(recipientRequest);

Console.WriteLine(recipient.id);

...

Example response (200 Ok)

{

"ok": true,

"recipient": {

"id": "R-1a3B3c4D5e6F7g8H9i0J1k",

"referenceId": "jsmith11@example.com",

"email": "jsmith11@example.com",

"name": "John Smith",

"lastName": "John",

"firstName": "Smith",

"type": "individual",

"status": "incomplete",

"language": "en",

"complianceStatus": "verified",

"dob": null,

"updatedAt": "2017-03-20T19:06:40.937Z",

"createdAt": "2017-03-17T20:10:45.818Z",

"gravatarUrl": "https://s3.amazonaws.com/static.api.trolley.com/icon_user.svg",

"placeOfBirth": null,

"ssn": null,

"tags": [],

"passport": "",

"payoutMethod": "bank-transfer",

"compliance": {

"status": "verified",

"checkedAt": "2017-03-20T19:06:23.916Z"

},

"routeType": "ach",

"routeMinimum": "1",

"estimatedFees": "1.25",

"accounts": [],

"address": {

"street1": "",

"street2": null,

"city": "",

"postalCode": "",

"phone": "",

"country": null,

"region": null

},

"primaryCurrency": "CAD"

}

}

Example response of Recipient with address (200 Ok)

{

"ok": true,

"recipient": {

"id": "R-1a3B3c4D5e6F7g8H9i0J1k",

"referenceId": "jsmith11@example.com",

"email": "jsmith11@example.com",

"name": "John Smith",

"lastName": "John",

"firstName": "Smith",

"type": "individual",

"status": "incomplete",

"language": "en",

"complianceStatus": "verified",

"dob": null,

"updatedAt": "2017-03-20T19:06:40.937Z",

"createdAt": "2017-03-17T20:10:45.818Z",

"gravatarUrl": "https://s3.amazonaws.com/static.api.trolley.com/icon_user.svg",

"placeOfBirth": null,

"ssn": null,

"tags": [],

"passport": "",

"payoutMethod": "bank-transfer",

"compliance": {

"status": "verified",

"checkedAt": "2017-03-20T19:06:23.916Z"

},

"routeType": "ach",

"routeMinimum": "1",

"estimatedFees": "1.25",

"accounts": [],

"address": {

"street1": "Apt# 14",

"street2": null,

"city": "",

"postalCode": "H3WXXX",

"phone": "",

"country": "CA",

"region": "QC"

},

"primaryCurrency": "CAD"

}

}

To create a Recipient, send a POST request to the /recipients

endpoint and include the user details in JSON format in the request

body. Each recipient will be assigned and represented by an

auto-generated ID (recipientId) which can be used to retrieve or

update recipient details at a later time.

HTTP Request

POST https://api.trolley.com/v1/recipients/

| Fields | Description |

|---|---|

| referenceId optional string |

Recipient reference ID as assigned by your business (your internal user reference number, e.g. U1234556678) |

| type required string |

Recipient type, either: business or individual |

| name conditional string |

Name of Business (e.g. ABC Company Ltd). Required if Type is business. (Note: If type is individual, we will automatically populate this field with firstName and lastName of individual). |

| firstName conditional string |

Recipient’s First name (e.g. John). Required if Type is individual. Optionally can provide contact persons first name if Type is business. |

| lastName conditional string |

Recipient’s Last name (surname), (e.g. Smith). Required if Type is individual. Optionally can provide contact persons last name if Type is business. |

| email required string |

Email address of recipient (e.g. john@email.com) |

| address optional address |

Address object. Please read the documentation |

| passport optional string |

Recipients valid passport number |

| dob optional date |

Recipient’s date of birth. The format should be YYYY-MM-DD, ie 1990-04-29 |

| phone optional string |

Recipient’s phone number (e.g. 415-123-0000 or +14151230000). Required for bank transfer payout method for these countries only: Argentina, Bangladesh, Brazil, Chile, China, Colombia, Costa Rica, Ethiopia, Fiji, Guatemala, Jordan, Kazakhstan, Kiribati, Korea (South), Mongolia, Russia, South Africa, Taiwan, Thailand, Tuvalu, Togo, Tonga. Otherwise it is optional. |

HTTP Response codes

| HTTP Code | Description |

|---|---|

| 200 | Recipient successfully created |

| 400 | One or more fields failed validation, see errors[] in response body |

| 401 | Invalid API key |

| 500 | Internal error |

Errors

This table lists the expected errors that this method could return.

However, other errors can be returned in the case where the service

is down or other unexpected factors affect processing. Callers

should always check the value of the ok params in the response.

| Error Code | Description |

|---|---|

| empty_field | A field is required |

| invalid_field | A field failed a validation check |

| invalid_api_key | Invalid API key |

| internal_server_error | Internal server errors |

Errors Example

If there is a validation error creating a recipients, the API will respond with an error. For example:

Response (406 Not Acceptable)

{

"ok": false,

"errors": [

{

"code": "invalid_field",

"field": "email",

"message": "Email is already exists"

},

{

"code": "empty_field",

"field": "name",

"message": "Expected to have a non-null or non-empty value"

}

]

}

Retrieve a recipient

Example Request

curl \

-H 'Authorization: prsign <ACCESS-KEY>:<SIGNATURE>' \

-H 'Content-Type: application/json' \

-H 'X-PR-Timestamp: <timestamp>' \

-X GET 'https://api.trolley.com/v1/recipients/R-1a2B3c4D5e6F7g8H9i0J1k' \

<?php

use Trolley;

Trolley\Configuration::publicKey('YOUR_ACCESS_KEY');

Trolley\Configuration::privateKey('YOUR_SECRET_KEY');

$recipient = Trolley\Recipient::find($recipient_id);

print_r($recipient);

?>

// Running in Node.js environment

const trolley = require("trolley");

const client = trolley.connect({

key: "YOUR_ACCESS_KEY",

secret: "YOUR_SECRET_KEY"

});

const response = await client.recipient.find(recipient.id);

console.log(recipient.id);

require 'trolley'

client = Trolley.client('YOUR_ACCESS_KEY', 'YOUR_SECRET_KEY')

response = client.recipient.find(recipient.id)

print response

from trolley.configuration import Configuration

client = Configuration.gateway(f'{ACCESS_KEY}', f'{SECRET_KEY}')

response = client.recipient.find(recipient_id)

print(response)

...

Configuration config = new Configuration("<ACCESS_KEY>","<SECRET_KEY>");

Gateway client = new Gateway(config);

String recipientId = getRecipientId();

// Get a recipient by ID

Recipient recipient = client.recipient.find(recipientId);

System.out.println(recipient.getId());

...

using Trolley.Types;

using Trolley;

...

Gateway gateway = new Trolley.Gateway("<ACCESS_KEY>", "<SECRET_KEY>");

string recipientId = GetRecipientId();

Recipient recipient = gateway.recipient.Get(recipientId);

Console.WriteLine(recipient.id);

...

You can retrieve details of a recipient account by sending a GET request to the /recipients/:id endpoint.

HTTP Request

GET https://api.trolley.com/v1/recipients/:id

| Fields | Description |

|---|---|

| id required string |

Recipient ID |

Example Response (200 Ok)

{

"ok": true,

"recipient": {

"id": "R-1a2B3c4D5e6F7g8H9i0J1k",

"referenceId": "jsmith11@example.com",

"email": "jsmith11@example.com",

"name": "Richard Hendricks",

"lastName": "Hendricks",

"firstName": "Richard",

"type": "individual",

"status": "active",

"language": "en",

"complianceStatus": "verified",

"dob": null,

"updatedAt": "2017-03-20T19:06:40.937Z",

"createdAt": "2017-03-17T20:10:45.818Z",

"gravatarUrl": "https://s3.amazonaws.com/static.api.trolley.com/icon_user.svg",

"placeOfBirth": null,

"ssn": null,

"tags": [],

"passport": "",

"payoutMethod": "bank-transfer",

"compliance": {

"status": "verified",

"checkedAt": "2017-03-20T19:06:23.916Z"

},

"routeType": "ach",

"routeMinimum": "1",

"estimatedFees": "1.25",

"accounts": [

{

"accountHolderName": "Richard Hendricks",

"bankId": "123",

"currency": "CAD",

"country": "CA",

"bankName": "TD CANADA TRUST",

"branchId": "47261",

"accountNum": "*****47"

}

],

"address": {

"street1": "Apt# 14",

"street2": null,

"city": "",

"postalCode": "H3WXXX",

"phone": "",

"country": "CA",

"region": "QC"

},

"primaryCurrency": "CAD"

}

}

| HTTP Code | Description |

|---|---|

| 200 | Recipient Object |

| 401 | Invalid API key |

| 404 | Recipient not found |

| 500 | Internal error |

Errors

This table lists the expected errors that this method could return.

However, other errors can be returned in the case where the service

is down or other unexpected factors affect processing. Callers

should always check the value of the ok params in the response.

| Error Code | Description |

|---|---|

| not_found | Object doesn’t exist |

| invalid_api_key | Invalid API key |

| internal_server_error | Internal server errors |

Errors Example

If recipient doesn’t exist, the API will respond with an error. For example:

Response (404 Not Found)

{

"ok": false,

"errors": [

{

"code": "not_found",

"message": "Object not found"

}

]

}

Update a recipient

Example Request

curl \

-H 'Authorization: prsign <ACCESS-KEY>:<SIGNATURE>' \

-H 'Content-Type: application/json' \

-H 'X-PR-Timestamp: <timestamp>' \

-X PATCH 'https://api.trolley.com/v1/recipients/R-1a3B3c4D5e6F7g8H9i0J1k' \

--data-raw '{

"firstName": "tom"

}'

<?php

use Trolley;

Trolley\Configuration::publicKey('YOUR_ACCESS_KEY');

Trolley\Configuration::privateKey('YOUR_SECRET_KEY');

$response = Trolley\Recipient::update($recipient->id, [

"firstName" => "Mark",

]);

print_r($response);

?>

// Running in Node.js environment

const trolley = require("trolley");

const client = trolley.connect({

key: "YOUR_ACCESS_KEY",

secret: "YOUR_SECRET_KEY"

});

const response = await client.recipient.update(

recipient.id,

{

firstName: "John"

}

);

console.log(response);

require 'trolley'

client = Trolley.client('YOUR_ACCESS_KEY', 'YOUR_SECRET_KEY')

response = client.recipient.update(

recipient.id,

{

firstName: 'Mark'

})

print response

from trolley.configuration import Configuration

client = Configuration.gateway(f'{ACCESS_KEY}', f'{SECRET_KEY}')

response = client.recipient.update(

recipient_id,

{

"firstName": "Jon"

})

print(response)

...

Configuration config = new Configuration("<ACCESS_KEY>","<SECRET_KEY>");

Gateway client = new Gateway(config);

String recipientId = getRecipientId();

// Update a recipient

Recipient updateRequest = new Recipient();;

updateRequest.setFirstName("Bob");

boolean response = client.recipient.update(recipientId, updateRequest);

System.out.println(response);

// Look at Recipient.Create request sample to learn how to set different fields

...

using Trolley.Types;

using Trolley;

...

Gateway gateway = new Trolley.Gateway("<ACCESS_KEY>", "<SECRET_KEY>");

string recipientId = GetRecipientId();

Recipient recipientRequest = new Recipient();

recipientRequest.firstName = "Bób";

Recipient recipient = gateway.recipient.Update(recipientId, recipientRequest);

Console.WriteLine(recipient.id);

...

Response (200 Ok)

{

"ok": true,

"recipient": {

"id": "R-1a3B3c4D5e6F7g8H9i0J1k",

"referenceId": "jsmith11@example.com",

"email": "jsmith11@example.com",

"name": "tom Smith",

"lastName": "Smith",

"firstName": "tom",

"type": "individual",

"status": "incomplete",

"language": "en",

"complianceStatus": "verified",

"dob": null,

"updatedAt": "2017-03-20T19:06:40.937Z",

"createdAt": "2017-03-17T20:10:45.818Z",

"gravatarUrl": "https://s3.amazonaws.com/static.api.trolley.com/icon_user.svg",

"placeOfBirth": null,

"ssn": null,

"tags": [],

"passport": "",

"payoutMethod": "bank-transfer",

"compliance": {

"status": "verified",

"checkedAt": "2017-03-20T19:06:23.916Z"

},

"routeType": "ach",

"routeMinimum": "1",

"estimatedFees": "1.25",

"accounts": [],

"address": {

"street1": "Apt# 14",

"street2": null,

"city": "",

"postalCode": "H3WXXX",

"phone": "",

"country": "CA",

"region": "QC"

},

"primaryCurrency": "CAD"

}

}

You can update the information of an existing recipient by sending

a PATCH request to the /recipients/:id endpoint.

Examples of this would be: recipient has a new street address, new payout

method, or new payout method details such as a different bank account number,

etc. You can also change the status of a recipient such as to active

or suspended.

Note: Account cannot be updated via this interface. Refer to Recipient Account for more information

HTTP Request

PATCH https://api.trolley.com/v1/recipients/:id

| Fields | Description |

|---|---|

| id required string |

Recipient ID |

HTTP Response codes

| HTTP Code | Description |

|---|---|

| 200 | Recipient successfully updated |

| 400 | One or more fields failed validation, see errors[] in response body |

| 401 | Invalid API key |

| 500 | Internal error |

Errors

This table lists the expected errors that this request could return.

However, other errors can be returned in the case where the service

is down or other unexpected factors affect processing. Callers

should always check the value of the ok params in the response.

| Error Code | Description |

|---|---|

| empty_field | A field is required |

| invalid_field | A field failed a validation check |

| invalid_api_key | Invalid API key |

| not_found | Object doesn’t exist |

| internal_server_error | Internal server errors |

Errors Example

If there is a validation error updating a recipient, the API will respond with an error. For example:

Response (406 Not Acceptable)

{

"ok": false,

"errors": [

{

"code": "invalid_field",

"field": "type",

"message": "Expected to have a non-null or non-empty value"

}

]

}

Delete a recipient

Example Request

curl \

-H 'Authorization: prsign <ACCESS-KEY>:<SIGNATURE>' \

-H 'Content-Type: application/json' \

-H 'X-PR-Timestamp: <timestamp>' \

-X DELETE 'https://api.trolley.com/v1/recipients/R-1a3B3c4D5e6F7g8H9i0J1k'

<?php

use Trolley;

Trolley\Configuration::publicKey('YOUR_ACCESS_KEY');

Trolley\Configuration::privateKey('YOUR_SECRET_KEY');

$response = Trolley\Recipient::delete($recipient->id);

print_r($response);

?>

// Running in Node.js environment

const trolley = require("trolley");

const client = trolley.connect({

key: "YOUR_ACCESS_KEY",

secret: "YOUR_SECRET_KEY"

});

const response = await client.recipient.remove(recipient.id);

console.log(response);

require 'trolley'

client = Trolley.client('YOUR_ACCESS_KEY', 'YOUR_SECRET_KEY')

response = client.recipient.delete(recipient.id)

print response

from trolley.configuration import Configuration

client = Configuration.gateway(f'{ACCESS_KEY}', f'{SECRET_KEY}')

response = client.recipient.delete(recipient_id)

print(response)

...

Configuration config = new Configuration("<ACCESS_KEY>","<SECRET_KEY>");

Gateway client = new Gateway(config);

String recipientId = getRecipientId();

// Delete one recipient

boolean response = client.recipient.delete(recipientId);

System.out.println(response);

...

using Trolley.Types;

using Trolley;

...

Gateway gateway = new Trolley.Gateway("<ACCESS_KEY>", "<SECRET_KEY>");

string recipientId = GetRecipientId();

bool delResult = gateway.recipient.Delete(recipientId);

Console.WriteLine(delResult);

...

To delete a Recipient, send a DELETE request to the /recipients endpoint with the recipientID. This places the recipient in archived state and can be un-archived.

HTTP Request

DELETE https://api.trolley.com/v1/recipients/:id

| Fields | Description |

|---|---|

| id required string |

Recipient ID |

Response (200 Ok)

{

"ok": true,

}

| HTTP Code | Description |

|---|---|

| 200 | Recipient successfully deleted |

| 401 | Invalid API key |

| 404 | Recipient not found |

| 500 | Internal error |

Errors

This table lists the expected errors that this method could return.

However, other errors can be returned in the case where the service

is down or other unexpected factors affect processing. Callers

should always check the value of the ok params in the response.

| Error Code | Description |

|---|---|

| not_found | Object doesn’t exist |

| invalid_api_key | Invalid API key |

| internal_server_error | Internal server errors |

Errors Example

If recipient does not exist, the API will respond with an error. For example:

Response (404 Not Found)

{

"ok": false,

"errors": [

{

"code": "not_found",

"message": "Object not found"

}

]

}

Delete multiple recipients

curl \

-H 'Authorization: prsign <ACCESS-KEY>:<SIGNATURE>' \

-H 'Content-Type: application/json' \

-H 'X-PR-Timestamp: <timestamp>' \

-X DELETE 'https://api.trolley.com/v1/recipients' \

--data-raw '{

"ids": [

"R-1a2B3c4D5e6F7g8H9i0J1k",

"R-1a2B3c4D5e6F7g8H9i0J1k"

]

}'

<?php

use Trolley;

Trolley\Configuration::publicKey('YOUR_ACCESS_KEY');

Trolley\Configuration::privateKey('YOUR_SECRET_KEY');

$deleteResult = Trolley\Recipient::deleteMultiple(

[

$recipientOne->id,

$recipientTwo->id

]);

print_r($deleteResult);

?>

// Running in Node.js environment

const trolley = require("trolley");

const client = trolley.connect({

key: "YOUR_ACCESS_KEY",

secret: "YOUR_SECRET_KEY"

});

const recipient = await client.recipient.create(

[

recipient1.id,

recipient2.id

]);

console.log(recipient.id);

require 'trolley'

client = Trolley.client('YOUR_ACCESS_KEY', 'YOUR_SECRET_KEY')

response = client.recipient.delete(

[

recipient1.id,

recipient2.id

])

print response

from trolley.configuration import Configuration

client = Configuration.gateway(f'{ACCESS_KEY}', f'{SECRET_KEY}')

payload = {

"ids": [

recipient1.id,

recipient2.id

]

}

response = client.recipient.delete_multiple(payload)

print(response)

...

Configuration config = new Configuration("<ACCESS_KEY>","<SECRET_KEY>");

Gateway client = new Gateway(config);

// Delete multiple recipients

List<Recipient> recipients = getRecipients();

boolean response = client.recipient.delete(recipients);

System.out.println(response);

...

using Trolley.Types;

using Trolley;

...

Gateway gateway = new Trolley.Gateway("<ACCESS_KEY>", "<SECRET_KEY>");

string recipientId1 = GetFirstRecipientId();

string recipientId2 = GetSecondRecipientId();

bool delResult = gateway.recipient.Delete(recipientId1, recipientId2);

Console.WriteLine(delResult);

...

Response (200 Ok)

{

"ok": true,

}

You can delete multiple recipients by sending a DELETE request to the /recipients endpoint.

HTTP Request

DELETE https://api.trolley.com/v1/recipients/

| Fields | Description |

|---|---|

| ids required array of strings |

Recipient IDs to delete |

| HTTP Code | Description |

|---|---|

| 200 | All recipients successfully deleted |

| 401 | Invalid API key |

| 404 | Recipient not found |

| 500 | Internal error |

Errors

This table lists the expected errors that this method could return.

However, other errors can be returned in the case where the service

is down or other unexpected factors affect processing. Callers

should always check the value of the ok params in the response.

| Error Code | Description |

|---|---|

| not_found | Object doesn’t exist |

| invalid_api_key | Invalid API key |

| internal_server_error | Internal server errors |

Errors Example

If any of the recipients do not exist, the API will respond with an error.

Response (404 Not Found)

{

"ok": false,

"errors": [

{

"code": "not_found",

"message": "Object not found"

}

]

}

List all recipients

Example Request

curl \

-H 'Authorization: prsign <ACCESS-KEY>:<SIGNATURE>' \

-H 'Content-Type: application/json' \

-H 'X-PR-Timestamp: <timestamp>' \

-X GET 'https://api.trolley.com/v1/recipients/' \

<?php

use Trolley;

Trolley\Configuration::publicKey('YOUR_ACCESS_KEY');

Trolley\Configuration::privateKey('YOUR_SECRET_KEY');

// Get all recipients

$recipients = Trolley\Recipient::all();

foreach ($recipients as $recipient) {

print_r($recipient);

}

// Search for recipients

$searchResults = Trolley\Recipient::search(

[

"name" => "Tom",

"page" => 1,

"pageSize" => 2

]

);

foreach($searchResults as $recipients){

print_r($recipients);

}

?>

// Running in Node.js environment

const trolley = require("trolley");

const client = trolley.connect({

key: "YOUR_ACCESS_KEY",

secret: "YOUR_SECRET_KEY"

});

const response = await client.recipient.search(1, 10, "John");

console.log(response);

require 'trolley'

client = Trolley.client('YOUR_ACCESS_KEY', 'YOUR_SECRET_KEY')

# List all recipients

response = client.recipient.search

print response

# Search for recipients

response = client.recipient.search(

1, # page number

10, # items per page

"John") # search term

print response

from trolley.configuration import Configuration

client = Configuration.gateway(f'{ACCESS_KEY}', f'{SECRET_KEY}')

# Searching recipients without any search term lists all recipients

recipients = client.recipient.search()

# Iterate through the generator to go through ALL the recipients with auto pagination

for recipient in recipients:

print(recipient)

# OR, get the recipients manually page-by-page

recipients = client.recipient.search_by_page(2,20)

# Iterate through the returned list for the requested page

for recipient in recipients:

print(recipient)

...

Configuration config = new Configuration("<ACCESS_KEY>","<SECRET_KEY>");

Gateway client = new Gateway(config);

int page = 1;

int pageSize = 10;

// Get all recipients with an optional search term and manual pagination

Recipients allRecipients = client.recipient.search(page, pageSize, "<search_term>");

List<Recipient> recipients = allRecipients.getRecipients();

for (Recipient recipient : recipients) {

System.out.println(recipient.getId());

}

...

// Or, with auto-pagination

RecipientsIterator recipients = client.recipient.search("<search_term>");

while(recipients.hasNext()) {

System.out.println(recipients.next().getId());

}

...

using Trolley.Types;

using Trolley;

...

Gateway gateway = new Trolley.Gateway("<ACCESS_KEY>", "<SECRET_KEY>");

string recipientId = GetRecipientId();

int page = 1;

int pageSize = 10;

// List all recipients with manual pagination and an optional search term

Recipients allRecipients = gateway.recipient.ListAllRecipients("<search_term>", page, pageSize);

// Get a List of Recipient objects to iterate over

List<Recipient> recipients = allRecipients.recipients;

// And get the Meta object to access pagination information

Meta meta = allRecipients.meta;

// Or, get all recipients with auto-pagination and an optional search term

var recipients = gateway.recipient.ListAllRecipients("<search_term>");

foreach (Recipient recipient in recipients)

{

Console.WriteLine(recipient.id);

}

...

Response (200 Ok)

{

"ok": true,

"recipients": [

{

"id": "R-1a2B3c4D5e6F7g8H9i0J1k",

"referenceId": "rhendricks@example.com",

"email": "rhendricks@example.com",

"name": "Richard Hendricks",

"lastName": "Hendricks",

"firstName": "Richard",

"type": "individual",

"status": "active",

"language": "en",

"complianceStatus": "verified",

"dob": null,

"updatedAt": "2017-03-20T19:06:40.937Z",

"createdAt": "2017-03-17T20:10:45.818Z",

"gravatarUrl": "https://s3.amazonaws.com/static.api.trolley.com/icon_user.svg",

"placeOfBirth": null,

"ssn": null,

"tags": [],

"passport": "",

"payoutMethod": "bank-transfer",

"compliance": {

"status": "verified",

"checkedAt": "2017-03-20T19:06:23.916Z"

},

"routeType": "ach",

"routeMinimum": "1",

"estimatedFees": "1.25",

"accounts": [

{

"accountHolderName": "Richard Hendricks",

"bankId": "123",

"currency": "CAD",

"country": "CA",

"bankName": "TD CANADA TRUST",

"branchId": "47261",

"accountNum": "*****47"

}

],

"address": {

"street1": "Apt# 14",

"street2": null,

"city": "",

"postalCode": "H3WXXX",

"phone": "",

"country": "CA",

"region": "QC"

},

"primaryCurrency": "CAD"

},

{

"id": "R-1a3B3c4D5e6F7g8H9i0J1k",

"referenceId": "jsmith11@example.com",

"email": "jsmith11@example.com",

"name": "John Smith",

"lastName": "John",

"firstName": "Smith",

"type": "individual",

"status": "active",

"language": "en",

"complianceStatus": "verified",

"dob": null,

"updatedAt": "2017-03-20T19:06:40.937Z",

"createdAt": "2017-03-17T20:10:45.818Z",

"gravatarUrl": "https://s3.amazonaws.com/static.api.trolley.com/icon_user.svg",

"placeOfBirth": null,

"ssn": null,

"tags": [],

"passport": "",

"payoutMethod": "bank-transfer",

"compliance": {

"status": "verified",

"checkedAt": "2017-03-20T19:06:23.916Z"

},

"routeType": "ach",

"routeMinimum": "1",

"estimatedFees": "1.25",

"accounts": [

{

"accountHolderName": "John Smith",

"bankId": "123",

"currency": "CAD",

"country": "CA",

"bankName": "TD CANADA TRUST",

"branchId": "47261",

"accountNum": "*****47"

}

],

"address": {

"street1": "Apt# 14",

"street2": null,

"city": "",

"postalCode": "H3WXXX",

"phone": "",

"country": "CA",

"region": "QC"

},

"primaryCurrency": "CAD"

}

],

"meta": {

"page": 1,

"pages": 1,

"records": 2

}

}

You can retrieve details of your recipients by sending a GET request

to the /recipients endpoint. Query parameters can be used in the

request to sort, filter or paginate the result set as intended.

For example, use this API to retrieve a list of all active recipients who live in New Zealand.

HTTP Request

GET https://api.trolley.com/v1/recipients

| Query Param | Description |

|---|---|

| page optional int |

The page number (default: 1) |

| pageSize optional int |

Number of records in a page (default: 10) |

| search optional string |

Prefix search of the name, email (username and domain-name) and referenceId |

| name optional string |

Prefix search of the name, firstName, lastName |

| email optional string |

Exact search of the email address |

| referenceId optional string |

Exact search of the referenceId |

| startDate optional date |

Ignore older records (based on update date) |

| endDate optional date |

Ignore newer records (based on update date) |

| status optional string |

Filter by recipient statuses |

| complianceStatus optional string |

Filter by pending, verified, blocked |

| country optional string |

Filter by ISO2 country code (comma separated list if multiple) |

| payoutMethod optional string |

Filter by paypal, bank-transfer, check |

| currency optional string |

Currency of recipient’s bank account. Required for bank transfer payout method. We support 3 letter ISO 4217 codes (e.g. EUR). Not required for PayPal. |

| orderBy optional string |

Field name: name, email, referenceId, payoutMethod, createdAt, updatedAt |

| sortBy optional string |

Sorting direction asc or desc (default: desc) |

| HTTP Code | Description |

|---|---|

| 200 | List of Recipient |

| 401 | Invalid API key |

| 500 | Internal error |

Errors

This table lists the expected errors that this method could return.

However, other errors can be returned in the case where the service

is down or other unexpected factors affect processing. Callers

should always check the value of the ok params in the response.

| Error Code | Description |

|---|---|

| not_found | Object doesn’t exist |

| invalid_api_key | Invalid API key |

| internal_server_error | Internal server errors |

Retrieve all logs

Example Request

curl \

-H 'Authorization: prsign <ACCESS-KEY>:<SIGNATURE>' \

-H 'Content-Type: application/json' \

-H 'X-PR-Timestamp: <timestamp>' \

-X GET 'https://api.trolley.com/v1/recipients/R-4QoXiSPjbnLuUmQR2bgb8C/logs' \

<?php

use Trolley;

Trolley\Configuration::publicKey('YOUR_ACCESS_KEY');

Trolley\Configuration::privateKey('YOUR_SECRET_KEY');

$recipientLogs = Trolley\Recipient::getAllLogs($recipient->id);

foreach ($recipientLogs as $activity) {

print_r($activity);

}

?>

// Running in Node.js environment

const trolley = require("trolley");

const client = trolley.connect({

key: "YOUR_ACCESS_KEY",

secret: "YOUR_SECRET_KEY"

});

const response = await client.recipient.findLogs(recipient.id);

console.log(response);

require 'trolley'

client = Trolley.client('YOUR_ACCESS_KEY', 'YOUR_SECRET_KEY')

response = client.recipient.find_logs(recipient.id)

print response

from trolley.configuration import Configuration

client = Configuration.gateway(f'{ACCESS_KEY}', f'{SECRET_KEY}')

offline_payments = client.recipient.retrieve_logs(recipient_id)

# Iterate through the returned offline payments list

for payment in offline_payments:

print(payment)

...

Configuration config = new Configuration("<ACCESS_KEY>","<SECRET_KEY>");

Gateway client = new Gateway(config);

String recipientId = getRecipientId();

int page = 1;

int pageSize = 10;

// Get Recipient Logs with manual pagination

Logs allLogs = client.recipient.getAllLogs(recipientId, page, pageSize);

List<Log> logs = allLogs.getLogs();

for (Log log : logs) {

System.out.println(log.getVia());

}

...

// Or, with auto-pagination

LogsIterator logs = client.recipient.getAllLogs(recipientId);

while(logs.hasNext()) {

System.out.println(logs.next().getVia());

}

...

using Trolley.Types;

using Trolley;

...

Gateway gateway = new Trolley.Gateway("<ACCESS_KEY>", "<SECRET_KEY>");

string recipientId = GetRecipientId();

// Get all logs with manual pagination

Logs allLogs = gateway.recipient.GetAllLogs(recipientId, 1, 10);

List<Log> logs = allLogs.logs;

// Or, get all logs with auto-pagination

var logs = gateway.recipient.GetAllLogs(recipientId);

foreach (Log log in logs)

{

Console.WriteLine(log.createdAt);

}

...

Response (200 Ok)

{

"ok": true,

"activities": [

{

"ip": "::ffff:10.0.2.2",

"url": "/v1/recipients/R-91XNW81D85DMG/log",

"method": "GET",

"headers": {

"host": "api.local.dev:3000",

"connection": "keep-alive",

"postman-token": "47cad157-855e-49fe-45d6-d61a02ffa802",

"cache-control": "no-cache",

"user-agent": "Mozilla/5.0 (Macintosh; Intel Mac OS X 10_12_3) AppleWebKit/537.36 (KHTML, like Gecko) Chrome/56.0.2924.87 Safari/537.36",

"x-api-key": "pk_live_*********************************",

"content-type": "application/json",

"accept": "*/*",

"accept-encoding": "gzip, deflate, sdch",

"accept-language": "en-US,en;q=0.8"

},

"request": "",

"response": "{\"ok\":false,\"errors\":[{\"code\":\"not_found\",\"message\":\"Object not found\"}]}",

"code": 404,

"source": "api",

"testMode": false,

"createdAt": "2017-03-22T17:57:32.786Z"

}

],

"meta": {

"page": 1,

"pages": 1,

"records": 2

}

}

You can retrieve a list of all activity related to a recipient by sending a GET request to the /recipients/:id/logs endpoint.

HTTP Request

GET https://api.trolley.com/v1/recipients/:id/logs

| Fields | Description |

|---|---|

| id required string |

Recipient ID |

| HTTP Code | Description |

|---|---|

| 200 | All recipients |

| 401 | Invalid API key |

| 404 | Recipient not found |

| 500 | Internal error |

Errors

This table lists the expected errors that this method could return.